WhatsApp)

WhatsApp)

Asset Purchase Due Diligence Template. An asset purchase, much like an acquisition or merger, requires substantial due diligence on the part of the buyer to ensure there are no unpleasant surprises. More specifically, the buyer must confirm a number of issues to .

Financial Due Diligence Checklist . Information concerning finances must also be added to the buyer due diligence checklist. Financial due diligence includes a target company's revenue, profits, financial assets, and risks. This aspect of due diligence gives potential buyers a .

identification of the person holding title to such assets and any material liens or restrictions on such assets. 9. Without duplication from Section D below, or separate intellectual property due diligence checklist, schedule of all intangible assets (including customer lists and goodwill) and

some unattractive mining assets early, and at a lower cost, whilst progressing other more attractive assets under greater scrutiny, and therefore at a larger cost. A well conducted due diligence goes beyond searching and finding flaws in a mining project or operating asset. It also looks at ways to manage or mitigate any problems that are ...

Mitigate Risk with This Acquisition Due Diligence Checklist Before fully committing to a transaction, you must first prepare an acquisition due diligence report. Use our Acquisition Due Diligence Checklist to help make sure you get the documents needed for an .

Nov 11, 2016· The following Tax Due Diligence Checklist is most applicable in terms of tax due diligence required by a buyer in a stock transaction to acquire another firm or business. [i] This checklist can be modified for use in the tax due diligence work required by the seller in a stock acquisition situation, the buyer or seller in an asset .

A technical due diligence, sometimes called an IT due diligence, helps IT managers check all essential Information Technology assets of a business during mergers and acquisitions. This is crucial for streamlining the management of IT assets and processes. iAuditor digital checklists .

Braziln construction and mining industry forecast; construction cone crusher; smb mining and construction machinery; Random link; uranium mine flow chart; due diligence checklist in acquisition of mining assets; various business spices grinder plant kolkata; coal mines provident fund; conveyor belt project report word doc; chrome mining plant

Mar 18, 2019· A Checklist For an Asset Purchase. Acquiring only some of the assets from a seller requires many of the same due diligence activities as the acquisition of the company. Additionally, a similar level of detailed due diligence is required in areas of the company which may not seem to be directly related to the asset purchase.

Discover what to look for when doing due diligence for the sale or purchase of an accounting firm. Advice includes how to handle staff, why clients matter so much, and how to review a firm's cash flow. Also learn how to balance confidentiality with providing enough information to prospective buyers.

Mining Due Diligence Checklist by Patrick F. Daniels Danyers & Co., Inc. February 21, 2017 Summary The following checklist covers eleven major risk categories typical of an advanced stage mining due diligence. Some of the categories are borrowed directly from the Canadian National Instrument Form 43-101F1 Technical Report.

Due Diligence: Purchasing a Business Action Checklist Buying a business involves careful consideration of many issues and as such should be undertaken in a systematic and methodical manner. The purpose of this checklist is to highlight some common areas for a business buyer to consider when buying a business. Item Yes No

T he due diligence is sin qua non for the purposes of investments, acquisitions, joint ventures, partnerships or such other essential investment ventures. It provides rational assurance on the investment related to assessment, financing, and purchase of assets. The mining companies, by its nature of exploration and mining, launch itself or try to get into a joint venture or other kinds of co ...

May 22, 2020· Due diligence is a process that helps determine the overall viability of a merger, an acquisition or an investment. An investor or an analyst has to cover a variety of areas to conduct due diligence of a prospective deal. Therefore, it is a common practice to make a due diligence checklist.

Technical Due Diligence in Mining Andrew J Vigar 26F, 414-424 Jaffe Rd, Wan Chai, Hong Kong SAR | Phone: +852 8198 8451|

Due diligence is completed before a deal closes. (DD) is an extensive process undertaken by an acquiring firm in order to thoroughly and completely assess the target company's business, assets, capabilities, and financial performance. There may be as many as 20 or more angles of due diligence .

L egal due diligence is without doubt an essential step in acquiring a mining project, and often determines the success of it. Given that direct asset acquisitions require the amendment of relevant licences and certificates, which can involve complex approval procedures loaded down with red tape, the equity acquisition method has become the preferred method in practice when acquiring a mining ...

Due Diligence for Mining Merger. Performing due diligence for the potential purchase of divested assets related to a merger of mining companies. 2015. England, Ireland, France, Romania, Switzerland, Canada, Brazil, Germany Slovakia, the Philippines. CRH.

Fixed assets can play an enormous role in financing an acquisition and helping an owner to obtain a loan. For this reason, Sellers need to spell out any and all of the company's fixed assets to Buyer during due diligence. This information includes the following: Listing of all fixed assets, with separate lists for owned assets and leased assets

Nov 12, 2019· So you have decided to purchase an existing business.Regardless of whether the deal is structured as an asset transaction, a stock transaction, or a merger, make sure you know what you are getting into by requiring detailed information from the seller regarding its business operations and finances.The following is a checklist of information and documents you should review.

Due diligence is a process during which a potential buyer of a company investigates that company to gain information to allow it to decide whether to go through with the acquisition. Due Diligence is the act of gathering and evaluating information about a target business.

Jul 01, 2019· Financial due diligence is the procedure a potential buyer of a company undertakes to assess the financial health and stability of the assets up for sale. To provide transparency and comfort to the acquiring party, financial data is scrutinised and any mitigating circumstances or areas which could potentially pose a risk are highlighted.

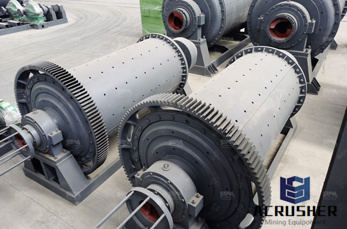

Technical due diligence is an important part of the positive asset acquisition cycle. A review by independent experts of the geological, mining, metallurgical and environmental technical parameters of an asset is critical to understanding the technical risks .

If the due diligence portion of the M&A process is completed with no major red flags, the buying organization generally proceeds forward with the transaction. HR Due Diligence Activities: Your M&A Checklist. Now that you understand what due diligence is in regards to the bigger M&A process, it is time to get into the nitty gritty.

WhatsApp)

WhatsApp)